Since several students asked about my dog, here is a picture of Lyra

Since this blog is supposedly about economics, here is a link to wagaroo a non-profit that helps match people in need of pets with pets in need of people. It was founded by University of Mary Washington econ alum Christine Exley, who went on to earn her Ph.D. at Stanford and is now a professor at Harvard Business School. Here is an interview that Frank Conway did with Christine at Economic Rockstar.

Here is the Fredericksburg SPCA, which is where Lyra came from.

This is a blog about economics, history, law and other things that interest me.

Thursday, January 17, 2019

Friday, November 2, 2018

The History of the History of Sears and Jim Crow

After the announcement that Sears had filed for bankruptcy

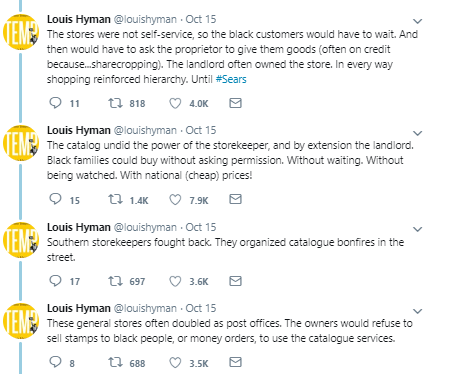

Louis Hyman put out tweet thread about Sears role undermining Jim

Crow in the South. The thread got thousands of likes and the story was picked

up by The

Chicago Tribune, The

New York Times, The

Washington Post, NPR,

and Vox.

I have posted a copy of the tweet thread below.

Not only is the story in Hyman and Hale the same, much of the wording is the same. Both contain the quotes: "just give the letter and the money to the mail carrier and he will get the money order at the post office and mail it in the letter for you" and “these fellows could not afford to show their faces as retailers.” It seems reasonable to infer that either Hale was Hyman's primary source or they both drew from the same sources.

Weil also describes the opposition of small retailers and their use of racial rumors.

The thread argues that Sears catalogs helped to undermine

Jim Crow. To preserve racial control, Southern store owners tried to

keep African Americans in the South from using Sears, but Sears responded to

this opposition. Sears not only acted to undermine Jim Crow it

did so intentionally.

Scott Cunnigham raised an interesting question to economic historians on twitter about how one might try to estimate the effect of the Sears catalog. So far as I know, no one has yet done that, but Elizabeth Ruth Perlman and Steven Sprick Schuster may be taking a stab at it (see here).

In addition, to the quantitative significance of the catalog, I wondered what sources the story was based upon. The story seems plausible, but what evidence is it based on? Like most people, Hyman doesn’t provide references for his tweets. The video also does not state the sources for the story, and it did not appear to be included in the American Capitalism Reader that he and Baptist put together. I tweeted a reply asking him about it, but it must have been one of the thousands of responses to the thread.

Scott Cunnigham raised an interesting question to economic historians on twitter about how one might try to estimate the effect of the Sears catalog. So far as I know, no one has yet done that, but Elizabeth Ruth Perlman and Steven Sprick Schuster may be taking a stab at it (see here).

In addition, to the quantitative significance of the catalog, I wondered what sources the story was based upon. The story seems plausible, but what evidence is it based on? Like most people, Hyman doesn’t provide references for his tweets. The video also does not state the sources for the story, and it did not appear to be included in the American Capitalism Reader that he and Baptist put together. I tweeted a reply asking him about it, but it must have been one of the thousands of responses to the thread.

Although I do not know for certain what source or sources Hyman used, Grace Elizabeth Hale told a similar in her Making

Whiteness: The Culture of Segregation in the South, 1890-1940 (1999). Here

are excerpts from pages and of Making

Whiteness.

The story is essentially the same. There is, however one noticeable difference between the

two stories in Hale’s version, even though she is writing a book about race, she says that store owners refuse to sell to people who had not paid their accounts. In Hyman's

version store owners refuse to sell to people because they are black. In the first,

store owners are opposing a competitor regardless of who the customer is. In

the second, the refusal is based on race. It is suggested, based upon the statement from the catalog about giving letters and money to the mail carrier, that Sears responded to these actions by the store owners. But the full quote from the catalog was "IF YOU LIVE ON A RURAL MAIL ROUTE, just give the letter and the money to the mail carrier.." The all caps is in the original. The instructions were repeated in Swedish and German.

Not only is the story in Hyman and Hale the same, much of the wording is the same. Both contain the quotes: "just give the letter and the money to the mail carrier and he will get the money order at the post office and mail it in the letter for you" and “these fellows could not afford to show their faces as retailers.” It seems reasonable to infer that either Hale was Hyman's primary source or they both drew from the same sources.

Hale sources are provided in two footnotes.

The first footnote is for the statements that rural storekeepers refused to sell stamps or money orders to some customers who owed on their accounts and the statement from the Sears Catalog about giving the money to your mail carrier. Thomas Clark states that : "Sometimes a customer was brought under control by the merchants refusal to order goods until he had paid his bill (page 73)." Clark was a prominent historian, but his The Southern Country Store does not provide citations. The other sources in that footnote refer to the catalog statement about giving money to the mail carrier. It is not clear, however, that Sears was trying to counter the actions of store owners rather than simply informing rural residents throughout the country that they could take advantage of rural free delivery and did not actually have to make a trip to the post office.

The other footnote cites three sources in support of the statements about rumors that Sears was black and the burning of catalogs: Stuart Ewen and Elizabeth Ewen Channels of Desire: Mass Images and the Shaping of American Consciousness published in 1982, Robert Hendrickson The Grand Emporiums: The Illustrated History of America’s Great Department Stores published in 1979, and Gordon L. Weil Sears Roebuck USA: The Great American Catalog Store and How it Grew published in 1977.

The first footnote is for the statements that rural storekeepers refused to sell stamps or money orders to some customers who owed on their accounts and the statement from the Sears Catalog about giving the money to your mail carrier. Thomas Clark states that : "Sometimes a customer was brought under control by the merchants refusal to order goods until he had paid his bill (page 73)." Clark was a prominent historian, but his The Southern Country Store does not provide citations. The other sources in that footnote refer to the catalog statement about giving money to the mail carrier. It is not clear, however, that Sears was trying to counter the actions of store owners rather than simply informing rural residents throughout the country that they could take advantage of rural free delivery and did not actually have to make a trip to the post office.

The other footnote cites three sources in support of the statements about rumors that Sears was black and the burning of catalogs: Stuart Ewen and Elizabeth Ewen Channels of Desire: Mass Images and the Shaping of American Consciousness published in 1982, Robert Hendrickson The Grand Emporiums: The Illustrated History of America’s Great Department Stores published in 1979, and Gordon L. Weil Sears Roebuck USA: The Great American Catalog Store and How it Grew published in 1977.

Ewen and Ewen say pretty much the same thing that Hale and

Hyman did

Ewen and Ewen do not mention the refusal to sell stamps and

money orders, but they do have the stories about rumors that Sears and

Montgomery Ward were black, including the quote about "these fellows." They also do not cite

Hendrickson and Weil.

Hendrickson also tells of rumors about race and catalog burning, but does not mention refusals to sell stamps or money orders:

Weil also describes the opposition of small retailers and their use of racial rumors.

So far the trail of citations has led us to Weil, who largely says

the same things that Ewen and Ewen did, but we can see that the quote about "these fellows" not showing their faces isn't actually evidence; it was just Weil’s interpretation.

What sources did Hendrickson and Weil base their interpretations on? Good

question. Neither Hendrickson or Weil is an academic history. There are no notes or references. Weil does, however, mention in his introduction that Catalogues and Counters: A History of Sears Roebuck and Company by Boris Emmet and John E. Jeuck was useful. (Seeing it listed on Amazon for $246 makes me feel fortunate to have picked up a copy at the library book sale for $2).

Emmet and Jeuck also tell the stories about rumors that Sears and Roebuck were black, and the story about small town merchants burning catalogs. Emmet and Jeuck were academics and their massive volume is heavily footnoted. The footnote in regard to the rumors about Sears and Roebuck being black cites an unpublished manuscript on the company's history written by Alvah Roebuck, suggesting that he remembered hearing such rumors as late as the 1930s. The footnotes about catalog burning and other opposition from small town merchants cites page 105 of Asher and Heal Send No Money Asher was a former Sears executive. Like the books by Weil and Hendrickson it does not cite sources. Page 105 does state that "George Milburn, in his book entitled "Catalogue," reveals the whole history of the home dealer's campaign against the mail order houses." George Milburn's Catalogue was a satirical novel about the the effects of the wish book on a small Oklahoma town.

I believe that I have now arrived at the end of the line. The claim about store owners refusing to sell stamps or money orders to blacks does not seem to appear in the previous literature. The claim that store owners refused to provide services to people whose accounts were not up to date appears to rest on Clark's statement in The Southern Country Store, which he does not provide any sources to support. Sears definitely told people they could give their money directly to postal carriers, but I did not find any evidence that they did this because of opposition from country store owners as opposed to just trying to make things easier for their customers. The claim about rumors that Sears and Roebuck were black appears to ultimately rest on the recollection of Roebuck in an unpublished manuscript. I wasn't able to trace the rumor about Ward past Weil and Hendrickson. The claims about catalog burning appear to be based on a novel.

The bottom line of all this is that we know very little about the impact of Sears in the South or other rural areas, and consequently we no little about its ability to undermine some of the results of Jim Crow. It is quite plausible that Sears provided large benefits like those suggested by Hyman, but we don’t know. It is possible that store owners spread rumors about race, but we have only Roebuck's recollection to that effect. It is possible that they organized catalog burnings, but we do not know. It is possible that some of Sears actions were attempts to counter racism, but we don’t know.

The bottom line of all this is that we know very little about the impact of Sears in the South or other rural areas, and consequently we no little about its ability to undermine some of the results of Jim Crow. It is quite plausible that Sears provided large benefits like those suggested by Hyman, but we don’t know. It is possible that store owners spread rumors about race, but we have only Roebuck's recollection to that effect. It is possible that they organized catalog burnings, but we do not know. It is possible that some of Sears actions were attempts to counter racism, but we don’t know.

Hyman’s tweet thread shouldn’t serve as a call to debate

whether or not Sears was an example of the positive aspects of capitalism. It should

be a call to historians to go out and actually find out what Sears did.

Sunday, October 21, 2018

Accounting for Slavery

I got around to reading Caitlin Rosenthal’s Accounting

for Slavery: Masters and Management. Rosenthal does not need me to sing

her praises. Plenty of people will be doing that. I’m just doing it because I

feel like it.

I do want to warn people that they should ignore some of the press

for the book that suggests it is about how slavery

inspired modern management. Rosenthal explicitly states that the book is

not about the origins of modern management. She draws parallels with

modern management practices, but she does not argue that they can be traced

back to slavery.

I use the phrase management practices because the subtitle

is more accurate than the title: the book is about much more than accounting. Rosenthal

examines the techniques that slave holders developed to track productivity,

record experiments, organize the flow of information up and down hierarchies, calculate

the value of their investments, etc. She shows how these techniques were

systematically disseminated through the publication of books with standardized

forms, articles in periodicals, and what were essentially how-to manuals on

plantation management. She makes the

case that an understanding of the degree to which slave owners developed sophisticated

management practices that parallel those in modern management adds to our

understanding of both business history and the history of slavery. In telling

the story she also makes clear that she would like to bridge the divide that currently exists between some economist economic historians and some

historian economic historians. If anyone has a chance of doing that it might be

someone who had Sven Beckert and Claudia Goldin as dissertation advisers.

Early in the book Rosenthal introduces an organizational

chart for a large sugar plantation, and she describes the parallel between the

way she created the chart and the way that Alfred Chandler created organizational

charts to demonstrate the development of management practices at large

industrial firms. The parallel with Chandler can be extended. Chandler argued

that management is an important element of technology. Institutions and

developments in production technology in the United States created possibilities

to profit from mass production, but to take advantage of these opportunities business

people had to develop the techniques to manage these large business enterprises.

Rosenthal shows that institutions (slavery) and technology (such as the cotton

gin) created opportunities to profit from large scale agricultural production,

but to take advantage of these opportunities business people had to develop techniques

to manage these large agricultural enterprises.

No book is perfect. I think she slightly exaggerates the

neglect of slavery by business historians. For instance, Blaszczyk and Scranton’s

Major Problems in American Business History gives as many pages to business in

the slaves south as it does to technology in the age of big business. Nevertheless,

her overall point that the business of slavery has been treated as distinct

from the main story is accurate. She also gives too much credit to Edward Baptist,

though she at least relegates this to a footnote. I’ll write a separate post

about why I disagree with her assessment of Baptist. For now, I want to emphasize that I think this

is an important book.

Finally, I want to note that it is one of the most well

written books I have read in a while. If you are looking for a historian who

wants to try to impress you with academic jargon or simply show you how many five dollar words they know, this is not the book for you. On the other hand, if you

want to see what it looks like when an author strives to make complicated

things as clear as possible you should take a look at this book.

If I were betting on future winners of the Hagley Prize for

the best book in business history, I would put my money on Accounting for

Slavery.

Thursday, October 18, 2018

Accounting for Capitalism

I read Michael Zakim’s new book Accounting

for Capitalism: The world the clerks made last week. I saw Tyler

Cowen’s brief review on Marginal Revolution, and Cowen included the

following excerpt from the book

A single block

fronting Wall Street in 1850 was thus home to seventeen separate banking firms,

as well as fifty-seven law offices, twenty-one brokerage houses, eleven

insurance companies, and an assortment of notaries, agents, importers,

commission merchants, and, of course, stationers. A rental market for

office “suites” developed apace “fitted up with gas and every other

convenience,” which also included newly invented “acoustic tubes” that allowed

managing partners to communicate with porters in the basement and clerks in the

salesroom without ever having to leave their desks…

All this office

activity spurred a flurry of technological spillovers that included single

standing desks and double-counter desks, sitting desks featuring nine or,

alternately, fifteen pigeonholes, and drawers that could or could not be

locked. “Office chairs capable of swiveling and tilting became available

as well, together with less costly “counting house stools” that lacked any

upholstery. Paperweights, check cutters, pen wipers (the woolen variety

being preferable to silk or cotton, which tended to leave fibers on the nib),

pencil sharpeners, rulers, copying brushes, dampening bowls, blotting paper

(less important for absorbing excess ink than for protecting the page from

soiled hands), wastepaper baskets, sealing wax (including small sticks coated

with a combustible material ignited by friction and designed to be discarded

after a single use), seal presses, paper fasteners, letter clips (for holding

checks while entering them into the daybook), writing pads, billhead and

envelope cases, business cards, receiving boxes for papers and letters, various

trays (for storing pins, wafers, pencils, and pens), and “counting room

calendars” spanning twelve- or sixteen-month cycles — all became standard

business tools. So did the expanding inventory of “square inkstands,”

“library inkstands,” and “banker inkstands” designed with narrow necks which

prevented evaporation and shallow bodies that kept the upper part of the pen

from becoming covered in ink, thus avoiding blackened fingers and smudged

documents.

He then added that “There is then a whole other paragraph about

the different kinds of paper that developed and their importance for clerical

work. This is perhaps the most thorough book I know on the importance of

“small” innovations, and it is also a useful book on the history of accounting.”

The impact of small technological changes and the history of

accounting, however, are not the central concerns of the book. Zakim’s book is more

about the subtitle “the world the clerks made.” It is business history, but it

is more on the cultural history part of the business history spectrum than the

technological, accounting, or economic history parts of the business history

spectrum. Zakim is not trying to explain changes in technology or accounting,

their spread, or their impact, or even changes in the number of clerks and the

functions they served. Instead, he is interested in the changes in thepeople perceived

the economy and their place in it. Those are interesting questions,

nevertheless, I found the book frustrating.

Capital and capitalism are words that have multiple

definitions, but Zakim doesn’t define how he is using them, and their meaning is

not made clear by the context. Often the use does not seem consistent with any

of the common uses of the terms.

Here are some of Zakim’s statements about capitalism:

“Anyone could become

a capitalist, Americans were told, a possibility that acted as a “spur to

exertion to the very news boys in our streets,” as did the popular intelligence

that the great majority of the country’s businessmen had “commenced life behind

a desk or the counter.” This did not mean, however, that everyone actually

became a capitalist, It did mean, however, that everyone became capital---or

what we so casually refer to as “human capital” today---rendering their own

lives the subject of utility and enterprise.” (Zakim page 7)

“The individual

became an asset worthy of the highest credit rating in a cash fraternity born

of the axioms of purchasability and personhood. He became human capital.”

(Zakim page 70)

“This perpetuum

mobile of life under capital---of dialectics at a standstill”---continues to induce

bouts of chronic fatigue and irritable bowels, panicked concerns with one’s

diet fed by a vast catechism of self help literature, and the body mass ratios of

exercise routines including performances of manual labor at the local cross fit

gym. Surely too, the treadmill desks of today are worthy successors to Dr.

Halsted’s equestrian exercise chair of 1846. Both mediate between our humanity

and the exigencies of the market, seeking to ameliorate the fraught

relationship between “Mammon and Man” that proves to be the common denominator

of capitalism’s reinvention of itself.” (Zakim page 194)

“Pen and paper

already engendered such a virtual reality, which was the condition for capitals

transmigrations from place to place, and form to form, passing between its

merchant, industrial and financial incarnations, and then back again, imbuing

the human imagination with the same values of fungibility. The history of capitalism is not, then, about the economic

origins of society, but about the expressions that economy assumes in society,

about how capital acquired consciousness.” Economists call this process

“cognitive regulatory capture.” (Zakim page 197)

Capital and capitalism appear frequently, but Zakim does not

say what he thinks those words mean, and it is not clear how his use fits with

common uses of the terms. Within economics capital is often used to mean two

different things. The most frequent use is as a factor of production. Undergraduate

students are taught that output is a function of land, labor, capital and

technology. In this context capital is anything that has been produced to enable

more production in the future. It includes factories, office buildings, and equipment.

It also includes things like roads, bridges, and ports. In addition, it

includes knowledge and skills that people have obtained that enable them to be

more productive, which is referred to as human capital. I’m pretty sure Zakim’s

use of “human capital” is not the same as economists. Capital is also used, especially in discussions of finance

and banking, to refer to the stake of the owners of a business. For instance,

after the last financial crisis there was a lot of discussion about increasing

capital requirements at banks to discourage excessive risk taking and provide a

cushion in case some loans or investments go bad.The Marxist view of capital, as best I recall, is distinct

from but related to both of these definitions of capital. I can't tell you what capital is for Zakim, only that it is important.

The book alternates between the sort of concrete

descriptions that Cowen highlighted and the less concrete statements about capitalism,

like those I have included here. Consequently, I found the book interesting but

somewhat frustrating. It is not clear to me what it means to say that “capital acquired consciousness.” I don’t

think it is what economists call cognitive regulatory capture, but it may be similar

to it.

If you are interested in learning about the evolution of

information technology and its impact of business and the economy I would

suggest that you might take a look at JoAnne Yates Control

Through Communication: The Rise of System in American Management , Margaret

Levenstein Accounting

for Growth: Information Systems and the Creation of the Large Corporation,

or Josh Lauer Creditworthy:

A History of Consumer Surveillance and Financial Identity in America. You

may also find some of the chapters in Daniel Raff and Phil Scranton (editors) The

Emergence of Routines: Entrepreneurship, Organization and Business History

interesting as well.

Wednesday, September 26, 2018

Henry Clay, Edward Baptist, and the Whipping Machine

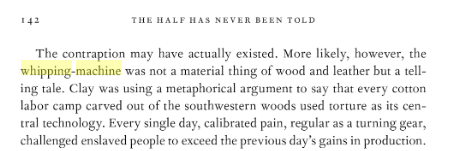

Along with the term “pushing system” that Baptist invented

and attributed to slaves and his fictional estimate of the economic impact of

slave produced cotton, the “whipping machine” has been one of the most frequently

cited stories from The Half Has Never Been Told. Foner, for instance, explained

in his New

York Times review “Each slave was assigned a daily picking quota, which

increased steadily over time. Baptist, who feels that historians too often

employ circumlocutions that obscure the horrors of slavery, prefers to call it

“the ‘whipping-machine’ system.” I saw it mentioned again recently and decided to look at the actual slave narrative that Baptist refers to. By this time I should not have been surprised at what I found. Nevertheless, I was.

Here is Baptist’s description

Henry Clay seems to be an almost perfect representative for

Baptist’s claims about slaves being moved to the cotton frontier of the Southwest,

where owners invented new ways to drive them harder.

Henry Clay’s slave narrative is in WPA

Oklahoma Slave Narratives. Here are the parts relevant to Baptist’s

interpretation.

In both versions Clay is born in North Carolina and then

sold and moved to Louisiana, and both include Clay’s description of a whipping

machine. But the whipping machine did not drive him to pick cotton faster in Louisiana

because it was not in Louisiana and he did not pick cotton in Louisiana. In

Clay’s narrative, the whipping machine was owned by his original master in

North Carolina, and Clay claims that he did not use it. According to Clay threats

were common on the North Carolina plantation but whipping was not. When his new

master took him to Louisiana he first cleared land and then was rented to a ship

captain. Eventually, he was taken to Oklahoma when he was inherited by the son

of the man that took him to Louisiana. Did the whipping machine actually exist? Baptist suggests not. He thinks Clay was using it as a metaphorical argument that "every cotton labor camp cleared out of the southwestern woods used torture as its central technology." Well, I don't think he was doing that since he placed it in North Carolina. Moreover, I don't see anything in the narrative suggesting that he was interested in making metaphorical arguments. If I had to choose between real and metaphorical I would probably go with real. The description is very specific and it is plausible. It sounds like a large spinning wheel with straps attached to the wheel. I have no guess as to whether it would have been functional or used. In the absence of corroborating evidence it is difficult to assess. The lack of corroborating evidence suggests that if it existed it was rare, if not unique.

The bottom line is that Henry Clay's story about the whipping machine is not the one that Baptist tells. One has to wonder at his point if there anything in the book that is faithful to the

sources that it is supposedly based on? The case of the whipping machine reinforces the fact that criticism of Baptist has nothing to do with different methods of historians and economists; it has everything to do with Baptist's failure to meet the standards by which historians have traditionally evaluated each others work.

Wednesday, September 5, 2018

That's Just Econ 101 Part 2

The other day I said that when someone says something is

just Econ 101 you can be confident it is probably not Econ 101. I have a couple more

examples now. Simon Johnson writes about Saving

Capitalism from Economics 101. He writes that

All across the United

States, students are settling into college – and coming to grips with “Econ

101.” This introductory course is typically taught with a broadly reassuring

message: if markets are allowed to work, good outcomes – such as productivity

growth, increasing wages, and generally shared prosperity – will surely follow.

Unfortunately, as my

co-author James Kwak points out in his recent book, Economism: Bad Economics and

the Rise of Inequality, Econ 101 is so far from being the whole story

that it could actually be considered misleading – at least as a guide to

sensible policymaking. Markets can be good, but they are also profoundly

susceptible to abusive practices, including by prominent private-sector people.

This is not a theoretical concern; it is central to our current policy debates,

including important new US legislation that has just been put forward.

One core problem is

that market incentives reward self-interested private behavior, without accounting

for social benefits or costs. We generally overlook our actions’ spillover

effects on others, or “externalities.” To be fair, Econ 101 textbooks do

discuss this issue in some contexts, such as pollution, and it is widely

accepted that environmental damage needs to be regulated if we are to have

clean air, clean water, and limits on other pollutants.

Unfortunately,

“widely accepted” does not include by President Donald Trump’s administration,

which is busy rolling back environmental protections across a broad range of

activities. The New York Times counts 76 rollbacks in progress. The thinking behind this policy

is straight out of the first few weeks of Econ 101: get out of the way of the

market. As a result, there is a lot more pollution – including more emission of

greenhouse gases – in America’s future.

What’s wrong with this?

1.

It is not what is taught in introductory econ

courses. I do not know of any textbook that makes the case that if markets are

allowed to work good things will surely follow. Mankiw is one of the more

politically conservative econ textbook authors. One of his ten principles is

that markets are usually a good way to organize economic activity, but it is

followed immediately by the principle that government can sometimes improve market

outcomes. The one chapter on perfect competition is followed by three chapters

on monopoly, oligopoly and monopolistic competition. There are chapters on

externalities, public goods and discrimination. If Mankiw isn’t teaching Ayn

Randian libertarianism, who is? Stiglitz? Krugman? I don’t think so.

2.

He then notes that this description of ECON 101

isn’t actually Econ 101. Economists do tell students about things like externalities.

And that the need for government regulation to protect the environment is “widely

accepted.”

3.

If it is not what is taught in Econ 101 what is

it? Turns out that it is the views of the Trump administration.

4.

Then Johnson immediately switches back to blaming

Econ 101. His argument seems to be “This is what you learn in Econ 101. Okay,

its not actually what you learn in Econ 101, but I’m going to keep blaming Econ 101 anyway. His coauthor Kwak uses the same approach in his

book.

5.

Blaming the Trump administrations economic

policies on Econ 101 is about as accurate as blaming his foreign policy on Introduction

to International Affairs courses.

At least this video on Economic Man versus Humanity: a

puppet rap battle has cool puppets. I like puppets. Right now, I’m looking

at the four marionettes from Prague that hang in my home office. Her rap, however, is terrible. Oh good lord

the verse she makes. It gives a chap the bellyache. She presents one of the most inaccurate interpretations of economic assumptions: that economists assume that

people should only care about money and things. You can gain satisfaction from

whatever you want: fancy cars, giving to charity, or baking great bread. There is

nothing in economics that says you should be making money instead of playing

music music, as the puppets apparently want to do. If you enjoy playing music,

you should probably play music, but, like any other choice, playing music has a

cost. You must give up something else

you could have done with that time and money. Economists don’t say what you

should want to do; they just say that, other things equal, if the benefits of

doing something goes up people will tend to do it more and if the costs go up

people will tend to do it less. And the stuff in the video about the planet

being here for our use. That’s not economics. That’s the weird fundamentalism of

Ronald Reagan’s secretary of the interior James G. Watt.

People who want to improve economic education need to start

with real economics. Not these silly straw man Econ 101s. As I’ve said before,

economics needs better critics.

Monday, August 20, 2018

Productive and Unproductive Error

The list of new working papers this morning from nep-his contained one by Richard Langlois,

“The Fisher Body

Case and Organizational Economics”, which examines the case of Fisher Body.

Mary and I also examined the case in our paper “The

historian’s craft and economics,” This blog post is both a concurring

and dissenting opinion on the Langlois paper.

Fisher Body was an early manufacturer of automobile bodies

that merged with General Motors in the 1920s. Both our paper and Langlois paper

are, however, less about the story of the merger than they are about the story

about the story. The story about the story begins when Klein, Crawford and

Alchian published a paper in 1978 that used Fisher Body as an example of

vertical integration driven by the holdup problem arising from asset

specificity. For non-economists the terms may be unfamiliar, but the intuition

is straightforward. The relationship between the automobile manufacturer and

the manufacturer of bodies will be most profitable if they make investments

that are fitted to each other. For example, the assembly plants are close to

the body plants, or the body plants are designed to produce the sort of bodies the

automobile company uses. In other words, you have assets, factory and equipment

that are specific to a particular use and much less valuable in alternative

uses. Hold up is the idea that once such investments have been made one side

can try to exploit the other. “We are going to lower the price we pay for your automobile

bodies, and you will have to accept it because no one else is going to buy

those bodies that are designed for our cars.” That is a really simplified

version, but you should get the idea.

In 1988, Klein described this explanation for the merger

“Fisher effectively held up General Motors by adopting a

relatively inefficient, highly labor-intensive technology and by refusing to

locate body-producing plants adjacent to general Motors assembly plant” (Klein,

1988: 202).

In 1988, Coase began to question this explanation, and he

and several other researchers presented considerable evidence that the sort of

holdup described by Klein never took place and that the merger was motivated by

other concerns. Klein and Coase argued back and forth, and several other people

jumped in. Ultimately Klein acknowledged that the hold up he described never

took place.

Both Coase and Hansen and Hansen present the case as an

example of economists’ failure to give sufficient attention to empirical

evidence. Langlois on the other hand sees the entire episode as an example of the

process of developing economic knowledge. Here is the conclusion of his paper

I agree with the overall thrust of Langlois argument but

disagree with his specific case. I think there are numerous examples of cases

where economists have developed explanations that turned out to be incorrect

but were important because they generated debates and stimulated research that

led to better understanding.

For instance, Doug North’s explanation for economic development

in the antebellum period prompted research into agricultural production in the South

and industrial development in the North that overturned his explanation and led

to a better understanding of antebellum development. I think a similar thing is

going on with Pomeranz’s work on the Great Divergence. Academics should not be criticized just for being wrong,

especially if it leads to research that improves our understanding of

something.

So what is the difference between North and Pomeranz, on the one

hand, and Klein et al, on the other. First, Klein et al simply use Fisher Body to

provide a little color to the theory. Their primary objective is not to

understand the history of Fisher Body and GM. The work of North and Pomeranz on

the other hand was driven by the desire to understand history. Second, North

and Pomeranz based their theories on the available evidence, and some of their

claims were later challenged by new and better evidence. The initial claim of Klein

et al was not based upon the available evidence. There was already evidence in

support of a contrary claim and no evidence in support of their claim that

Fisher held-up GM. Finally, the responses to North and Pomeranz took us beyond

where we were before they wrote. In contrast, the responses to Klein et al

largely took us back to where we were before. According to Langlois

The use of Fisher by Klein et al is an example of trying to

cram history into a theory rather than using theory to understand history. When

I was studying economic history at the LSE in the early ‘80s I became

increasingly interested in the use of economic theory in economic history. My

advisor, Geoff Jones, told me that theory could be very useful but that I had

to be careful not to try to make a historical story fit into a theory. Theory

might help guide the search for evidence, but you have to go where the evidence

leads you even if that doesn’t fit your theory. And you must tell the story

honestly. Although I went on to get a

Ph. D. in economics rather than history, I have always tried to keep Geoff’s

advice as a guiding principle. I think Klein et al would have been less likely to follow the path they did if they had been driven by a desire to understand Fisher Body.

Wednesday, August 15, 2018

That's Just Econ 101

The other day my wife and I were talking about how people

like to use phrases like “that’s just Econ 101”. Unfortunately, statements that

precede that phrase are almost never Econ 101. It’s just whatever the person

happens to think. I said that fairy tales should be re-written to include the

phrase. “If you don’t make the shoes, elves will do it at night. That’s just

Econ 101.” "He spins straw into gold. That's just Econ 101."

Bill Gates provided support for the claim that people to tend to say things about basic economic theory that are not part

of economic theory.

He says that it costs as much to build the 1,000th

unit as it cost to produce the 10th. Economists call the additional

cost of producing another unit of a good marginal cost. What he is describing

is constant marginal cost. The problem is that he drew an upward sloping supply

curve. An upward sloping supply curve means that higher and higher prices are

required to get suppliers to provide additional units of the good. Why are

higher and higher prices required? Because of increasing marginal cost. Gates

description of constant marginal cost is thus inconsistent with his graph. This

is actually a small problem because Gates could have just as well said that economists

assume increasing marginal cost when drawing typical supply and demand curves.

His real point seems to be that there are now many goods for which there are large startup costs and near

zero marginal costs. That is how he describes software production. He suggests

that this is a new development that arises from the intangible

nature of goods like software.

It is not actually a new situation, it does not arise from

the product being intangible, and undergraduate economic textbooks have models

of this situation. There are many examples

of products for which there are very large start up costs and relatively small

(near zero) constant marginal cost. Railroads are not new, and they are not

intangible, but they required large expenditures on construction and, once built,

the additional cost of another passenger or another bushel of wheat was practically

zero. Insurance is intangible, but it is

not obvious that it can be produced at zero marginal cost.

This is a graph from McCloskey’s Applied Theory of Price, which, by the way, is available to you at

the amazingly low cost of your time to download it.

Gates does not address the demand side but these are generally firms that have some degree of market power. They face a downward sloping demand like the firm in the graph. Because other people do not regard other goods as perfect substitutes the firm won't lose all of its customers if it raises its price. The more the firm can convince people that other goods are not close substitutes for its good the greater its ability to raise its price above marginal cost. I some ways the more important thing is whether it can keep other companies from offering close substitutes. In other words, can it create what economists call barriers to entry. You can have a great idea, but if you can't keep other people from copying it you are not going to make great profits.

In short,

1. If you want to charge a price that is greater than marginal cost you need to convince people that other goods are not close substitutes for yours. Think of the old Porsche slogan: "Porsche. There is no substitute."

2. If you want to make more than an average rate of profit you need to keep other people from copying you, that is introducing substitutes for your good (or you need to keep coming up with new things that don't have close substitutes).

Those two ideas actually are Econ 101.

Subscribe to:

Posts (Atom)